The eclipse of economic rationalism?

Written by: (Contributed) on 23 January 2024

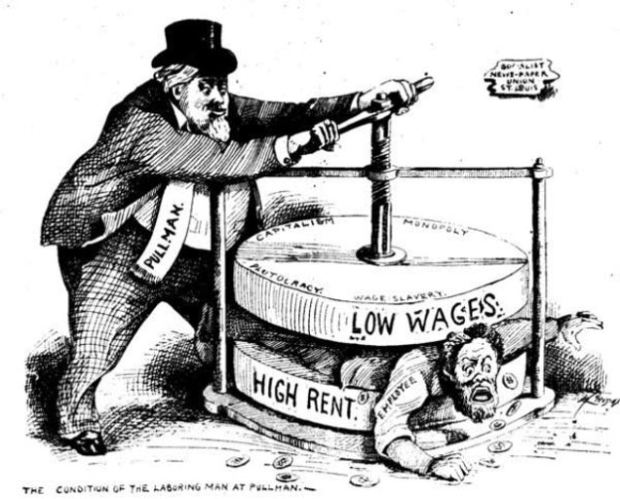

(Above - this US cartoon from over a century ago reflects an enduring truth about capitalism)

A recent report from the OECD has revealed how governments are increasingly using tax-payers money for state-controlled programs, as GDP continues to decline. (1) In fact, the global economy is on present track to record the slowest GDP growth in three decades. (2)

An official IMF projection has already concluded that Australia will face a major downturn to a mere 1.2 per cent economic growth this year. (3)

Economic rationalism became vogue thinking for the business-classes and corporate sector during the 1980s. International financial institutions including the World Bank and International Monetary Fund foisted programs of privatisation, de-regulation and liberalisation through trade bodies in order to keep the US at the centre of the global economy; globalisation became the order of the day. A prominent feature of economic rationalism was 'trickle-up' patterns whereby the rich became even richer at the expense of the mass of the population.

An OXFAM report in 2020, for example, established the richest one per cent of the world's population had grabbed two-thirds of the $42 trillion of 'new wealth', while the remaining 99 per cent acquired the remainder. (4) It also established that the fortunes of billionaires were increasing by US$2.7 billion each day, while 1.7 billion workers lived in countries, such as Australia, where wages were outpaced by inflation and CPI. (5)

An IMF report in late 2023 officially recorded that the global economy was 'limping along … not sprinting … growth remains slow and uneven … with widening divergences'. (6)

It is important to note, therefore, that the latest World Bank report, Global Economic Prospects, noted 'a grim outlook beyond the next two years' … the outlook is dark … what looms … is a wretched global growth performance'. (7) There has been a general decline in economic growth over decades: during the 2010s, the average was 3.1 per cent, it is now barely 2.4 per cent and not expected to rise higher. (8) Global trade figures, likewise, have also declined: it is now expected to be only half this year, of an annual average during the decade before the pandemic. (9)

The recent Global Risks Report released by the World Economic Forum, likewise, forecast 'a doomsday scenario of events which could occur in the future'. (10)

The business-classes and the corporate sector, however, were well aware of the looming problems and have already taken precautionary measures to safeguard their positions and stabilise economic systems. It was done with very little publicity and was often hidden amongst indirect forms of support; in South Australia, for example, many companies use government subsidies for 'training provision', with numerous courses linked to private training agencies.

A significant increase in the role of state spending in recent years, nevertheless, has included 'an array of new spending needs, from military priorities to industrial policy'. (11) It marks a shift away from previously held economic rationalist models which emphasised a reduction in state support for business.

The change has been particularly noticeable in the European Union where government spending is now accounting for half of the region’s economic output in 2023. (12) Higher interest rates, globally, have also made their mark; re-payment on existing debt levels has already been recorded rising from 104 per cent of GDP in 2019, to 112 per cent in 2023. (13) They are set to rise even higher.

What is significant is that the business-classes and corporate sector expect governments to use tax-payers money as subsidies, while continuing to gloat over their own profits. Some of their businesses, furthermore, do not even pay tax. It has led to an official statement from a major European bank that 'this means many rich countries … have no alternative to raising tax revenues’. (14)

In conclusion, the economic rationalist business model foisted on countries by international financial institutions can be seen to not have produced healthy, vibrant economies, but those which require government support to maintain their existence.

Ordinary tax-payers are paying subsidies for the business-classes and corporate sector.

It is a disgrace!

The old trade-union slogan from a century ago of 'I work, you work, they profit', would appear to still be holding and highly relevant!

1. Tax take on the rise as borrowing declines, Australian, 20 December 2023.

2. World Bank's 'hazard' warning, Australian, 10 January 2024.

3. Global economy still limping along: IMF., Australian, 11 October 2023.

4. Survival of the richest, OXFAM publication, 2020.

5. Ibid.

6. Australian, op.cit., 11 October 2023.

7. Australian, op.cit., 10 January 2024.

8. Ibid.

9. Ibid.

10. Black swans on horizon, Australian, 11 January 2024.

11. Australian, op.cit., 20 December 2023.

12. Ibid.

13. Ibid.

14. Ibid.

Print Version - new window Email article

-----

Go back

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| Productivity Commission wonks still pushing discredited economic rationalism |

| ADSTAR: Info-wars and the military, Canberra, 2024 |

| Madeleine King: Helping the Pentagon to our nickel |

| Binskin appointment comes with a conflict of interest |

| “Grey-Zone” intelligence assessments and real-war scenarios |

| As Australia aids Israeli genocide, Elders say it’s time to target Pine Gap. |

| MUA HERE TO STAY - supporting their members and the Palestinian people |

| US submarine visits not welcome and will never be “normal” |

| A tale of two payments… |

| AUKUS: Jobs diversion scheme |

| Transparency: who will the Australian Government listen to? |

| Australia surrenders sovereignty again: integrates with US-UK military exports and RnD |

| Cancel the Elbit contract! |

| ADF in trouble as personnel leave in droves |

| Heads must roll to clear Defence of US loyalists |

| January 26, what’s to celebrate but struggle? |

| The eclipse of economic rationalism? |

| Can Australian workers manufacture electric cars? Yes we can – dump the nuclear subs. |

| US wants Australia to stockpile the weapons it would need for war with China |

| Military Satellite Project JP1902: Class and State Power in Australia |

-----